Biden Administration’s Proposed Capital Gains Tax Increase

Content Header

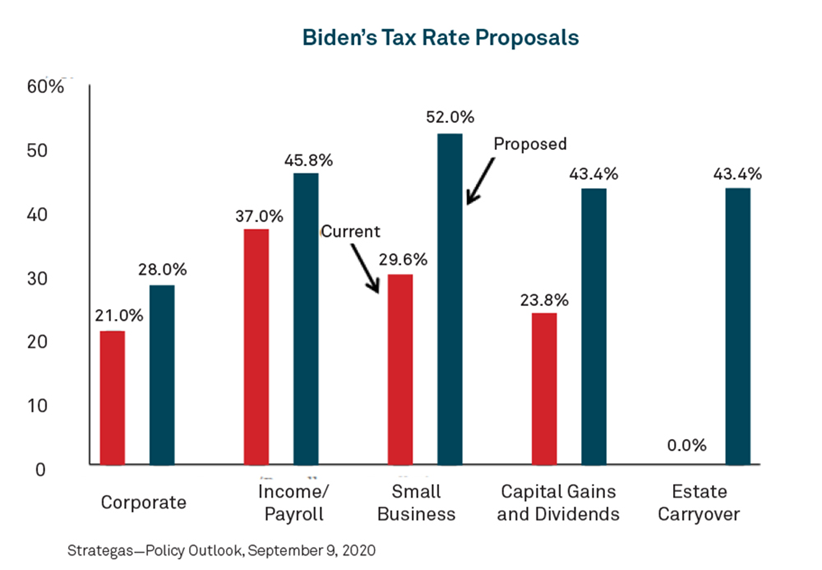

In an Effort to generate revenue to pay for his American Families Plan, President Biden has proposed several income tax changes, some of which will significantly impact real estate investors. Chart 1 below illustrates five of the tax changes that have been proposed.

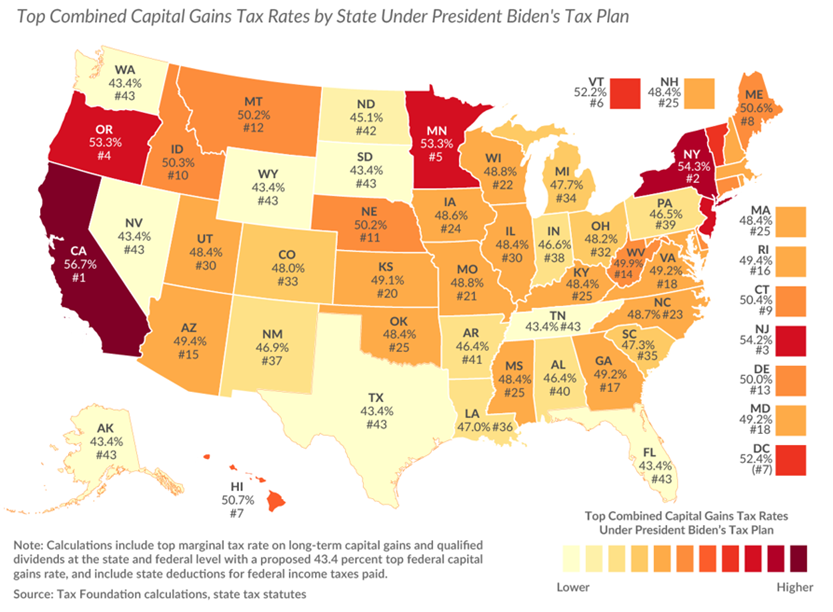

This discussion will focus on the proposed increase in the capital gains tax rate to 39.6% from the current rate of 20%.1 Once the 3.8% Net Investment Income tax (aka “the Obama Care tax”) is added in, the proposed capital gains tax rate will be 43.4% at the federal level for individuals who have annual income that exceeds $1 million. The rate will be even higher than 43.4% in many U.S. states because of state and local capital gains taxes. Chart 2 below shows the combined capital gains tax rates in the individual states. The combined federal and state AVERAGE capital gains tax rate will be approximately 48%2 if the proposed increase takes effect. At these proposed tax rates, it is not an understatement to say that investment, whether it be in real estate, stocks, bonds or otherwise, will be challenging for high income and high net worth investors who provide much of the capital for business investment. An excessive capital gains tax rate can and does influence when an investor decides to sell their capital assets and recognize their accumulated capital gains.

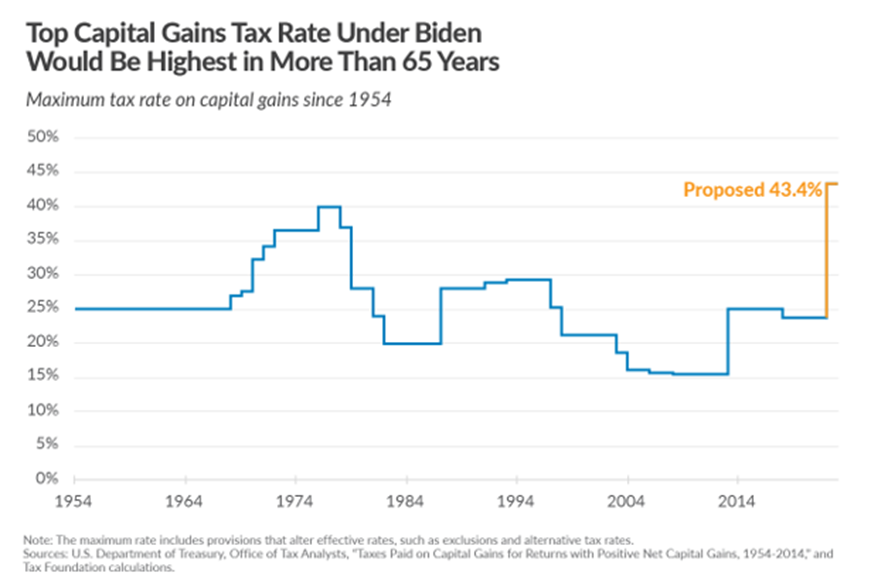

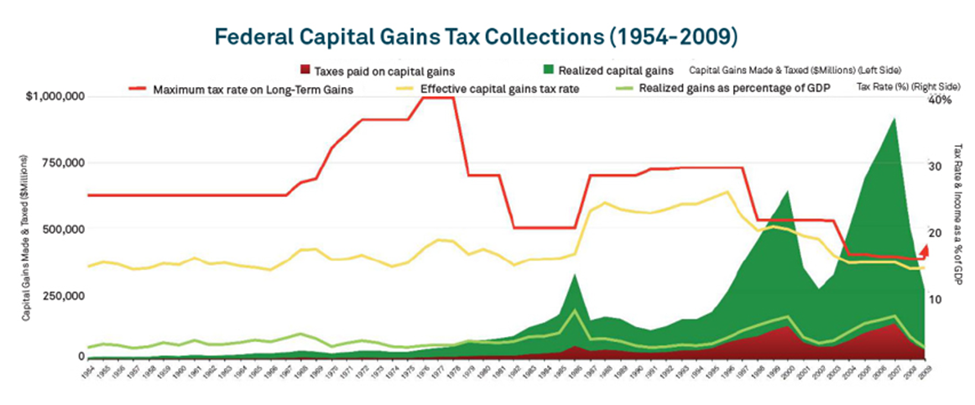

As shown in Chart 3 below, if the proposed capital gains tax rate is approved by Congress, then it will be the highest capital gains tax rate since 1954. According to the Tax Foundation, raising the top capital gains tax rate to 39.6 percent for those earning over $1 million would reduce long-run gross domestic product by about 0.1 percent and reduce, not increase, federal revenue by approximately $124 billion over 10 years. The Tax Foundation further states that "under Biden’s proposal for capital gains, the U.S. economy would be smaller, American incomes would be reduced, and federal revenue would also drop due to fewer capital gains realizations."

Historical data shows that when capital gains tax rates are lowered more federal tax revenue is generated and when those tax rates are raised, particularly to excessive levels, less federal tax revenue is generated. See Chart 4 below. This is because investors can and do determine when to dispose of their capital assets and recognize the capital gains that they have accumulated. To the extent that investors can choose the appropriate and most tax-efficient time to sell their assets (i.e., they are not forced to sell the asset) they will sell their assets at a time when the tax liability will be the least. Historically, taxpayers show a proclivity for employing strategies to defer capital gains taxes to a future tax year as a consequence of dealing with tax increases. An increase in the capital gains rate frequently triggers the “lock-in” effect where investors do not sell assets in order to avoid the recognition of gain and the higher tax liability that would flow therefrom. The “lock-in” effect can lead to market inefficiency and does little to improve the long-term level of output and long-term economic growth.

Finally, from an economic viewpoint, savings and investment increase the amount of capital available in the economy and ultimately the amount of goods and services available in the overall economy. Capital is the lifeblood of capital investment. Without it there is no investment. Capital investments are frequently long-term investments that allow companies to generate revenue for many years by adding or improving production facilities and boosting operational efficiency. A dramatic increase in the capital gains tax has the potential to decrease the savings (i.e., capital) available for investment in the economy. This will adversely impact business formation, productivity and, in general, the adversely impact the overall economy. It will not raise the tax revenue that is projected to be raised. The adverse impact on the commercial real estate industry will be significant and disruptive and that cannot be overstated.

1 The maximum capital gains tax rate today is actually 23.8% when the Net Investment Income Tax is included in the calculation.

2 For real estate investors who live in jurisdictions that impose a local capital gains tax rate in addition to the state capital gains tax rate, their tax rate could be greater than 50%. For example, New York City imposes a capital gains tax rate of 3.876% in addition to the New York State capital gains tax burden. That means that the New York City investor would face an all-in tax rate of nearly 58.2%.